Terminal Capitalism

The new era heralded by Trump’s second term

Many commentators in the 21st century have taken to calling our current social and economic era “late stage capitalism.” As no one agrees how exactly to define the phrase, nor when the stage it indicates supposedly began, the best place to clarify its meaning without getting bogged down in detail and disagreement is probably the dictionary:

late-stage capitalism

: the current stage of capitalism that began in the second half of the 20th century and that is characterized by globalization, the dominance of multinational corporations, broad commodification and consumerism, and extreme wealth inequality

My contention, as we transition into Donald J. Trump’s second term as the president of the United States of America, is that late stage capitalism is over and that we have entered a new era best labelled terminal capitalism.

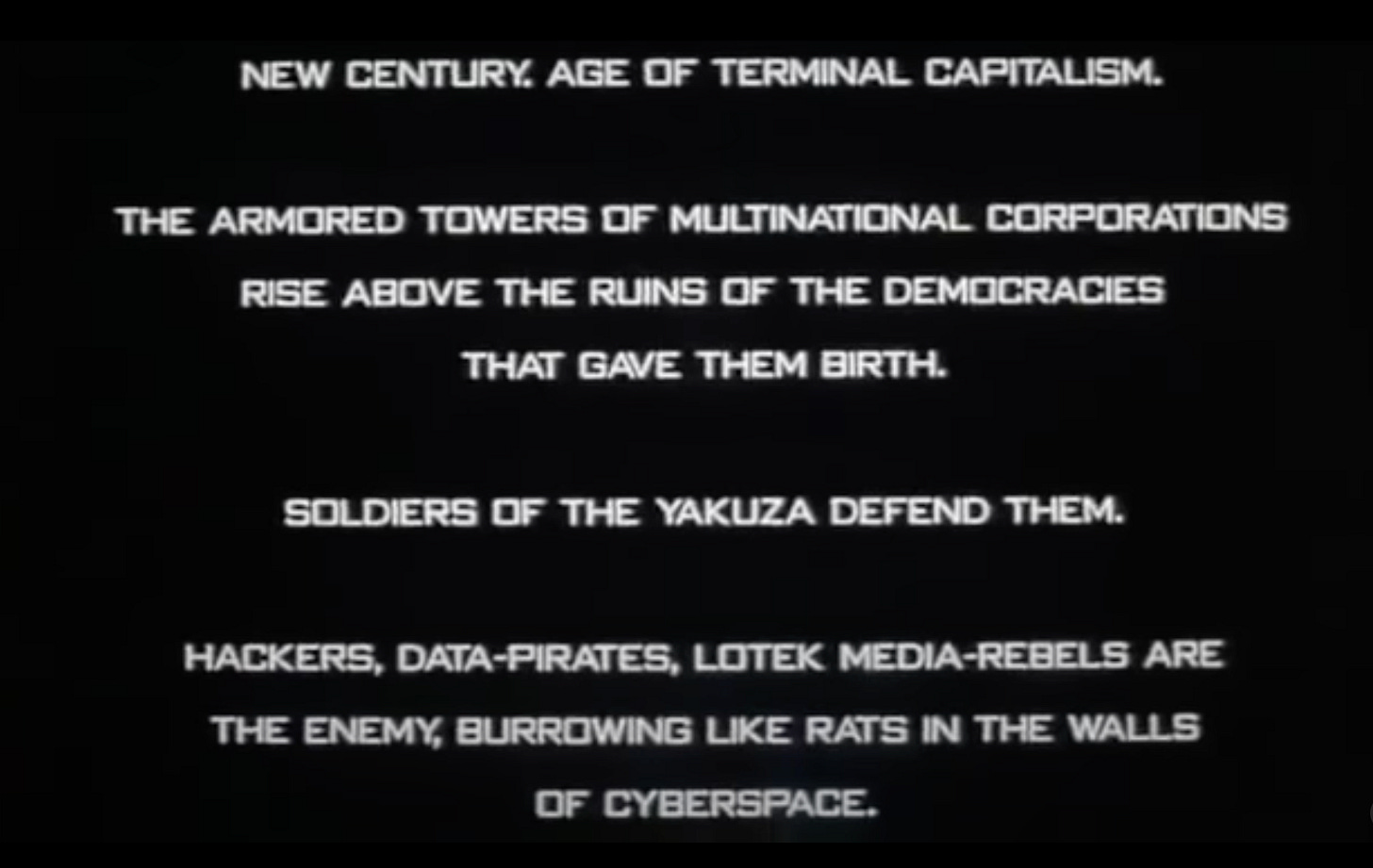

I hit upon the phrase terminal capitalism when writing my 2024 sci-fi novelette The MachineGarden,1 where it refers to the final era of global civilization before emergence of a post-scarcity, post-work, and post-human social system called the WorldGame. However, it turns out, unsurprisingly, that I did not coin it. A notable early usage of terminal capitalism is in the opening narration for the 1995 Canadian-American film Jonny Mnemonic.2

It’s tempting to conclude that terminal capitalism is another neologism we owe to cyberpunk maestro William Gibson3, who wrote the screenplay, but there are even earlier examples of its use within academia. The earliest I could find was from 1972:

A more thorough search than I am capable of might reveal yet earlier instances. The point is that terminal capitalism is of long vintage and has been coming into wider use in the 21st century.

Generally, the notion of terminal capitalism is relegated to the domains of either dystopian speculation, as in my story and Gibson’s screenplay, or of ethereal academic abstraction, as in books, essays, and lectures written by humanities professors. But I do not think that it belongs any longer on the horizon of a fictional future that will never arrive, any more than in the remote jargon of specialized disciplines. Due to changes that have been unfolding for at least the past decade, terminal capitalism now accurately evokes the social and economic era we are living through right now—more accurately at least than late stage capitalism, which carries an increasingly quaint and passé ring to it.

I do not mean to suggest that anything within late stage capitalism is definitively over. Although the phenomenon of globalization is certainly transforming within the multipolar world order that has emerged since America squandered its post Cold War global hegemony and shrewd players like China ascended to claim pieces of it, multinational corporate power, commodification, consumerism, and wealth inequality are all still very much alive and well; if anything, they are intensifying. Rather, the historical phase of terminal capitalism is characterized for the most part by the interweaving of new elements with the old.

Here I’ll identify three shifts that I believe signal the arrival of terminal stage capitalism. With more careful consideration, I’m certain that we could identify more. I focus here on the USA because, despite its precipitous social and political decline, it remains, sadly, the closest nation we have to a global leader, and changes that first take hold there inevitably ripple outward to transform the world. Indeed, all of the shifts I describe below can already be identified elsewhere.

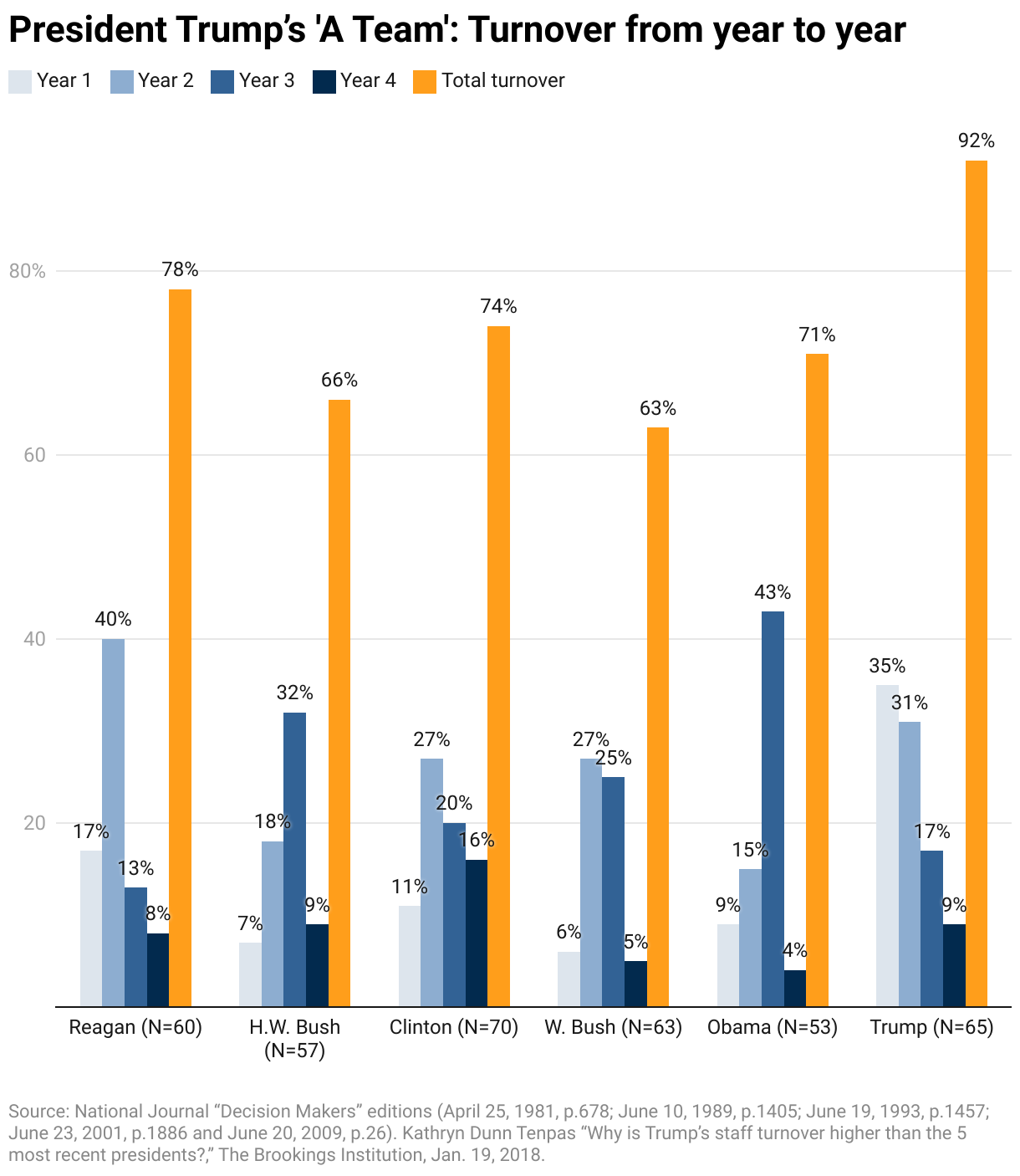

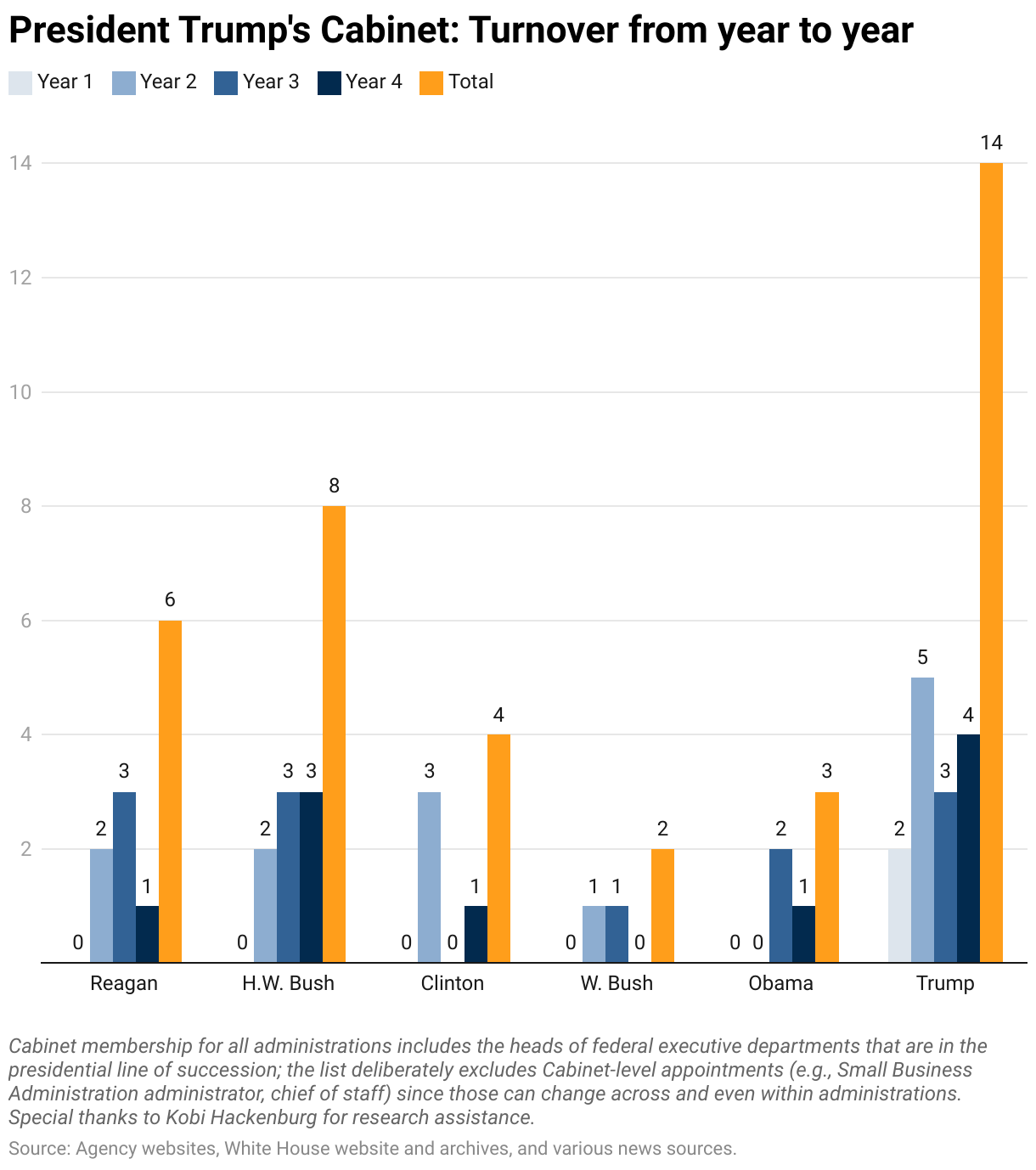

First is the enshrinement of the wealthiest man in the world, Elon Musk, alongside his extremely-wealthy-but-not-quite-yet-billionaire sidekick, Vivek Ramaswamy, as an unofficial federal institution. The mandate of the so-called Department of Government Efficiency, or DOGE, is supposedly to slash and burn the government.4 It is unclear, however, what this augurs for the American project. Does this constitute an plutocratic coup of the centres of state power? Or is it merely another doomed effort to reduce bureaucratic bloat in a polarized bicameral system liable to gridlock on even the simplest issues? It is impossible for anyone, inside the administration or out, to predict how this unprecedented intervention will pan out. I wouldn’t be surprised if the notoriously mercurial Trump, who had the highest total staff turnover of any president on record in his first term, falls out with Musk before DOGE achieves anything worth mentioning.

Be that is it may, what is clear is that the elected billionaire set to oversee the world’s largest economy has now invited unelected billionaires (or soon to be billionaires) to fiddle directly with the levers of state power. I do not doubt that our historians can dig up analogous events, but this strikes me as a momentous change to how capitalism has heretofore operated. The ongoing background influence of corporate and oligarchic lobbying is old hat in all Western-style democracies; the flagrantly transparent institutionalization of plutocratic authority feels startlingly new.5

The second shift is the imminent integration of cryptocurrencies into the core of the US financial system. This integration has, in fact, already begun. Since introduction of Bitcoin futures ETFs in 2021 and Bitcoin spot ETFs in early 2024, the number of approved funds that provide exposure to Bitcoin and other major cryptocurrencies like Ether has grown rapidly; investors can now choose between dozens of such crypto ETFs through standard trading accounts. These developments, however, are just a prelude to the entrenchment we can expect now that the crypto lobby has the ear of Trump, who they converted from an advocate for the supremacy of the American dollar to a sworn cryptobro. This buyout of the president all but guarantees regulatory capture and the institutional embrace of cryptocurrency. Given the extreme volatility, opacity, decentralization and other distinctive features of crypto-based assets, their widespread sale through traditional financial markets will yield severe and long-lasting economic consequences that we can hardly begin to fathom.6

The third shift is the divorce between capitalism and liberalism. It is not as though the two have never been twain. Nazi Germany, fascist Italy, and late imperial Japan all merged totalitarian regimes with capitalist economic systems. However, nearly every influential capitalist state since WWI has been bound up with liberalism, by which I mean the rule of law and enforcement of principles such as human rights that limit state power over individuals. Neoliberalism was the dominant ideology from the mid 1970s through to approximately the 2010s, but it has not been succeeded since falling out of favor by another strain of liberalism. Capitalism and liberalism seem to have decided, in a growing list of countries—from Russia, China and Singapore to Hungary, Poland, and Turkey—to simply part ways. The decline of American liberalism at home that began with erosion of civil liberties under the Patriot Act passed in 2001 evolved in Trump’s first term into an attack on liberalism abroad, which is now set to culminate under his second.

The institutionalization of plutocracy, embrace of cryptocurrency, and dissociation of liberalism and capitalism seem sufficient to establish the conclusion of late-stage capitalism and the inauguration of a new phase we ought to call terminal capitalism. However, some might think that my declaration of the end of an era is premature. The actions of the first Trump administration were hindered by so many problems, they will say, that despite all the bluster he may fail to institute even basic policies, let alone the dramatic overhaul I have described. Indeed, the forces of MAGA seem to be pushing back against the agendas of the tech and crypto bros in their attempted regression to a supposed manufacturing golden age (though no one in the orbit of the administration seems to care one whit for liberalism…).

There is some truth to this critique. Trump redux will almost certainly be as incoherent and fickle as take one. However, if we consider the constellation of powers at Trump’s disposal, it seems unlikely that he will be ineffectual. Not only does Trump wield the unholy hybrid of cryptotech plutocracy and the White House, with all the funding and executive powers this implies, and the MAGA mob, who are ever eager to swarm his enemies, but the Republican party Trump helms controls both chambers of Congress and the Supreme Court, three justices of which Trump himself appointed. Moreover, a Supreme Court ruling last year has effectively granted the president total legal impunity; if there was ever any doubt, Trump can now officially do no wrong. So while the plutocratization, cryptofication, and deliberalization of capitalist democracy may be diluted or diverted somewhat by the messiness of Trumpian rule, there should be little doubt as to his potential and intention to permanently alter the course of both the American and global order.

What does this all add up to? I say terminal capitalism, but not in the purely pessimistic sense that the phrase might initially imply. The adjective “terminal” does suggest ailment and death, as when we say terminal cancer. This connotation expresses the fear shared by many that global civilization cannot possible go on like this, that everything is destined to fall apart. The problem, of course, is that we cannot be sure that this stage of capitalism is the last one. Perhaps the ever resilient engine of human activity and commerce will undergo yet another metamorphosis, and the word terminal will turn out to have been a misnomer.

But this is precisely where the optimism in terminal capitalism comes in. Because the term should not be treated merely as a description; it contains the seed of hope for renewal. The end of something finite is by its nature the beginning of something else. So terminal capitalism gestures to the dream of a better human civilization, if not post-work or post-money, than at least post drudgery, post radical inequality, post war, and post climate crisis.

I cannot see what is coming next, though I have a few inklings. All I can say for certain is that the world as we know it is rehearsing its swan song.

1: My novelette, The MachineGarden, can be read in The Dance anthology of speculative fiction short stories that feature alternate realities.

2: It felt as though I independently discovered “terminal capitalism” in the course of my own imaginative exploration when writing The MachineGarden. However, I must admit that I saw Jonny Mnemonic around the time it came out, so, although I did not even recall that it contained an opening narration, let alone that it contained “terminal capitalism”, and could not have consciously borrowed the phrase from the film, perhaps the term lay nested amorphously within my subconscious for three decades. Who can say how the human mind works?

3: Gibson famously coined the term cyberspace in his debut novel Neuromancer:

“Cyberspace. A consensual hallucination experienced daily by billions of legitimate operators, in every nation, by children being taught mathematical concepts… A graphic representation of data abstracted from banks of every computer in the human system. Unthinkable complexity. Lines of light ranged in the nonspace of the mind, clusters and constellations of data. Like city lights, receding…”

4: Ironically, the first move of DOGE has been to hire new workers, increasing government costs: https://www.cbsnews.com/news/musk-department-of-government-efficiency-doge-jobs-applicants-hiring-x/

5: Russia under Putin may serve as a similar case, but it’s period in the 90s and oughts as anything resembling a Western democracy was extremely short-lived.

6: A systemic risk that concerns me is the scenario in which a combination of financial deregulation and crypto institutionalization could lead to the opaque bundling of cryptocurrency into other assets, much as sub-prime mortgages were unwittingly included en masse in mortgage-backed securities, resulting in the sub-prime mortgage crisis that was the proximate cause of the 2007/2008 global financial crisis. Similarly, if cryptocurrencies become integral parts of other securities and investors outside the cryptosphere become heavily invested, the next crypto crash could trigger the next global depression.

About The Author

Eli K.P. William is the author of The Jubilee Cycle (Skyhorse), a trilogy set in a dystopian future Tokyo, and a translator of Japanese literature, including most recently the bestselling memoir The Traveling Tree (Hachette) by renowned photographer Michio Hoshino. He also writes in the Japanese language, serving as a story consultant for a well-known video game company, and contributing short stories to such publications as a 2025 anthology put out by Japan’s largest sci-fi publisher. His translations, essays, and works of fiction have appeared in Granta, Aeon, Monkey, and more.

Eli K.P. William is the author of The Jubilee Cycle (Skyhorse), a trilogy set in a dystopian future Tokyo, and a translator of Japanese literature, including most recently the bestselling memoir The Traveling Tree (Hachette) by renowned photographer Michio Hoshino. He also writes in the Japanese language, serving as a story consultant for a well-known video game company, and contributing short stories to such publications as a 2025 anthology put out by Japan’s largest sci-fi publisher. His translations, essays, and works of fiction have appeared in Granta, Aeon, Monkey, and more.

Read Eli’s full bio.